The tax code provides two tax advantageous plans for taxpayers to pay medical expenses. One is a Flexible Spending Account (FSA) and the other is a Health Savings Account (HSA). The two are often misunderstood and their provisions are frequently mixed up by taxpayers who then fail to take advantage of the tax benefits available from these accounts.

This article explains the workings, qualifications, and tax benefits of each with a side-by-side comparison chart of the two programs. Both have a common theme: contribution to both is made with pre-tax dollars (they reduce taxable income) and distributions to pay qualified medical expenses are tax free. After that the two plans are quite different.

Flexible Spending Accounts (FSAs)

There are three types of FSAs: dependent care assistance, adoption assistance and medical care reimbursements. This article will only be dealing with the latter, often referred to as a Health FSA.A Health Flexible Spending Account is part of a qualified cafeteria plan offered by an employer, that allows employees to contribute pre-tax dollars annually to be used by the employee to pay medical expenses of the employee, their spouse, and dependents during the year. The maximum contribution is annually inflation adjusted, and for 2023 is $3,050 (up from $2,850 in 2022).In the case of a married couple where each spouse has an FSA account with an employer, both can contribute the maximum.

Since an FSA is an employer plan, an employee cannot take it with them if they leave their employment. Thus, FSAs are not transferrable and cannot be rolled into an individual’s health savings plan.

Common Features of an FSA – Funds can be used for health insurance deductibles, copays, medication, and other health care related out-of-pocket costs. For ease of use, most FSA accounts come with a debit card. Employees can spend the money in the account before it’s fully funded.

FSA Allowable Medical Expenses Include Those For:

- The diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body,

- Prescription Drugs,

- Medication available without a prescription (an over-the-counter medicine or drug) that is prescribed),

- Insulin,

- Transportation primarily for and essential to medical care,

- Supplementary medical insurance for the aged,

- Feminine menstrual products, and

- Personal Protective Equipment (COVID)

No Double Dipping – Medical expenses reimbursed from the FSA cannot be claimed as a Schedule A medical itemized deduction.

Unused Amounts (Use It or Lose It) – Unused amounts at the plan’s year end are generally forfeited by the employee. However, a plan can have either:

- A grace period of up to 2½ months after the end of the plan year in which to use up the unused amount or

- Allow up to 20% of the annual contribution limit ($610 for 2023)of unused amounts from the end of the plan year to be used to pay or reimburse qualified medical expenses in the following year.

Unused amounts more than the carryover amounts are forfeited (cannot be returned to the employee). The carryover amount does not reduce the maximum contribution amount allowed for the carryover year.

FSA participants need to pay close attention to their FSA account balances to ensure they do not forfeit any funds at year’s end.

Health Saving Accounts (HSAs)

Individuals must meet the following requirements to contribute to an HSA:

- Not be claimed as a dependent on anyone else’s tax return.

- Not be enrolled in Medicare.

- Covered under a high-deductible health plan (HDHP) and not be covered under any other health plan which is not an HDHP, unless the other coverage is permitted insurance or coverage for accidents, disability, dental care, vision care, or long-term care.

Enrolled in Medicare – The IRS has interpreted being “enrolled in Medicare” to mean both eligibility for and enrollment in Medicare. An individual who is otherwise eligible, but who is not enrolled in Medicare Part A, may contribute to an HSA until the month enrolled in Medicare.

Covered Under a High-deductible Health Plan – HDHPs come in two varieties: Self-Only plans and Family plans. Use the flow chart below to determine if a plan qualifies as a high-deductible health plan.

HSA Contributions and Contribution Limits – Individuals may establish an HSA either independently or with their employer. If made with an employer, and the individual subsequently leaves the employment, the individual can roll the funds into their own HSA or take a taxable distribution subject to a 20% penalty.

In addition to the individual, others can make contributions to the HSA, including employers as well as other persons (e.g., family members) subject to the annual inflation adjusted contribution limits. Those limits for 2023 are:

- $3,850 for self-only coverage

- $7,750 for family coverage

- $1,000 additional amount for those aged 55 and older.

An account holder gets the deduction for contributions to his HSA even if someone else (e.g., a family member) makes the contributions. Employer contributions to an HSA are excluded from the employee’s income – so these contributions are not deducted on the employee’s tax return. Distributions for qualifying medical expenses are tax-free.

HSA Allowable Medical Expenses – Generally the eligible medical expenses are the same as allowed for FSAs. The qualified medical expenses must be incurred only after the HSA has been established. Medical expenses paid or reimbursed by HSA distributions cannot also be claimed as a medical expense for itemized deduction purposes.

HSA as a Supplemental Retirement Vehicle – Establishing and contributing to an HSA can be more than just a way for individuals to save taxes and gain control over their medical care expenditures. It can also be a retirement vehicle, especially for taxpayers who are maxed out on their other retirement plan options or who can’t contribute to an IRA because of the income limitations.

There is no requirement that medical expenses must be paid or reimbursed from the HSA, so a taxpayer can maximize tax-free growth in the account by using funds from other sources to pay routine medical costs. Later, distributions can be used tax-free to pay post-retirement medical expenses. Or, if used for non-medical purposes, a retiree aged 65 or older will pay income tax on the distribution, but not a penalty. Those younger than 65 who use their HSA funds for other than qualified medical purposes pay a penalty of 20% of the amount distributed in addition to income tax on the distribution. Unlike IRAs, no minimum distributions are required to be made from HSAs at any specific age.

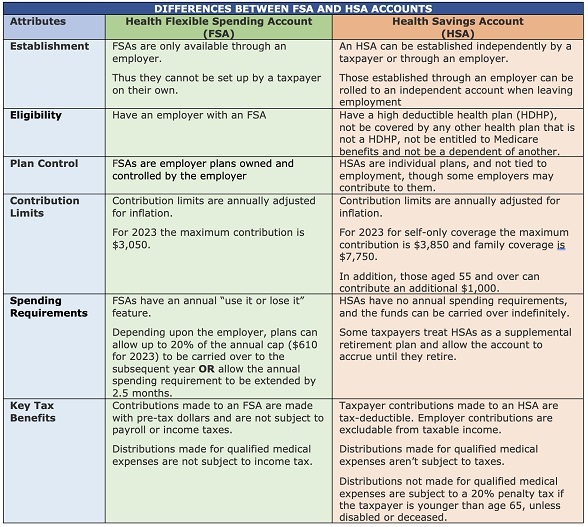

FSA-HSA Comparison Table

The following table compares the key differences between Health Flexible Spending Accounts and Health Savings Accounts:

As you can see, either an FSA or HSA can help you pay your out-of-pocket medical expenses. On top of that, contributions are made on a pre-tax basis directly reducing your taxable income. If in an employer plan, in addition to reducing your taxable income, contributions reduce payroll taxes. Plus an HSA can be a supplemental retirement vehicle.

Please give us a call if we can help you utilize the tax benefits of a health FSA or an HSA.

P.S. Being audited can seem scary, that’s why you need the right support. We’ve got that part down. Click to schedule your free one on one call with one of our partners today and let us navigate the unknowns!